The One Big Beautiful Bill and What It Means for Your Retirement

The new law brings both relief and responsibility for retirees.

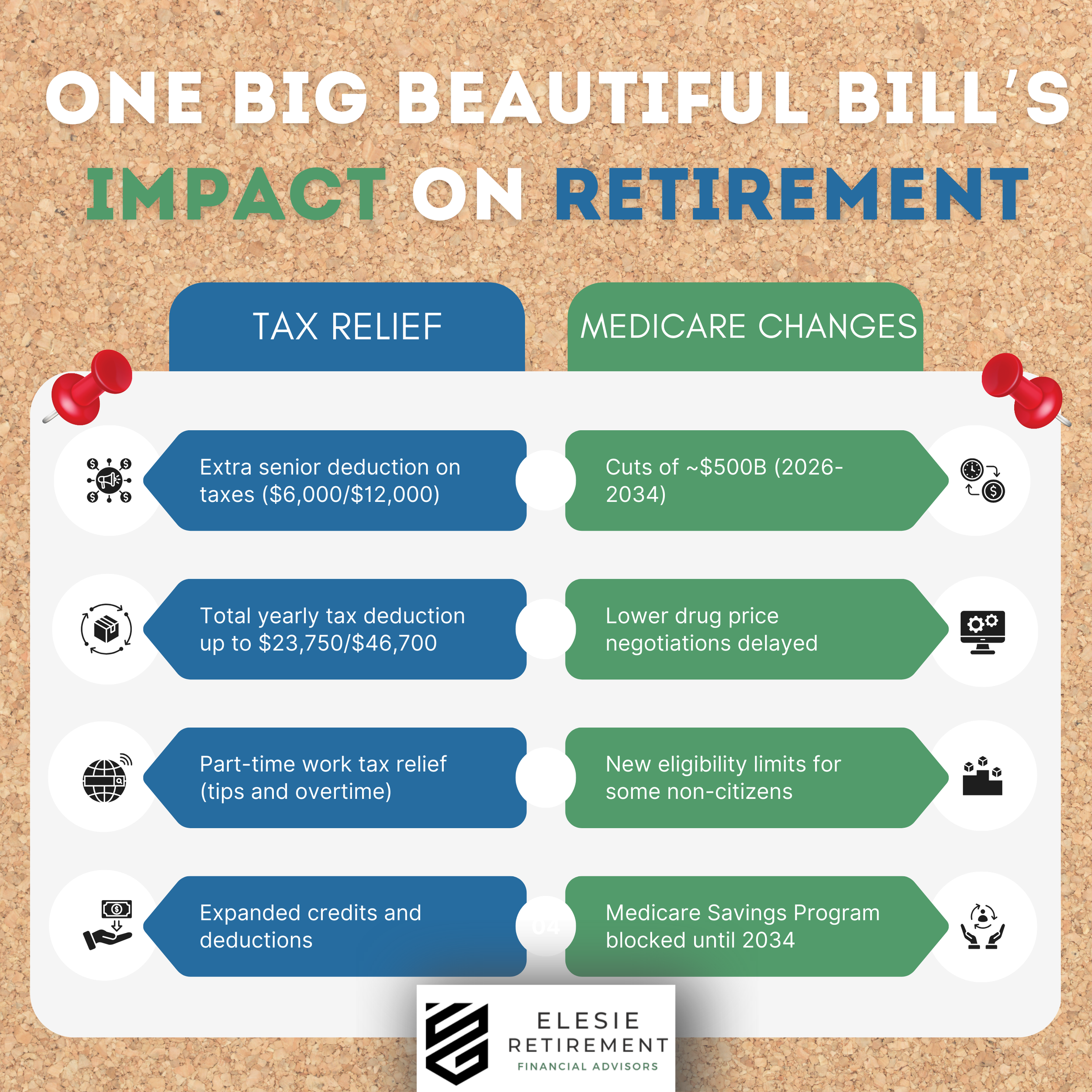

When Margaret, a 68-year-old retired teacher in Ohio, contacted us for retirement and tax planning, she discovered more than just new numbers. The One Big Beautiful Bill Act of 2025 had quietly rewritten the rules, raising deductions for seniors like her while reshaping the financial foundation of retirement itself. The law delivers meaningful tax relief, but it also brings deep cuts to Medicare and questions about the long-term stability of Social Security. For millions of Americans entering or already in retirement, the challenge is clear: capture the benefits today while preparing for the uncertainties tomorrow.

Key Provisions That Affect Retirees

1. Enhanced Standard Deduction for Seniors

If you are 65 or older, you may now qualify for a much larger standard deduction. The new law adds an extra $6,000 for single filers or $12,000 for married couples filing jointly. This deduction begins phasing out at incomes above $75,000 for singles or $150,000 for couples and is eliminated entirely beyond $175,000 and $250,000.

How the New Totals Are Calculated:

The maximum standard deduction for seniors comes from three parts:

Base Standard Deduction (2025 IRS figures): $15,750 (single) or $31,500 (married filing jointly)

Existing Extra Deduction for Seniors (65+): $2,000 (single) or $3,200 (married, both 65+)

New OBBBA Senior Bonus Deduction: $6,000 (single) or $12,000 (married, both 65+)

Total Standard Deduction Available:

Single filer age 65+: $15,750 + $2,000 + $6,000 = $23,750

Married couple both 65+: $31,500 + $3,200 + $12,000 = $46,700

For many households, this represents thousands of dollars in additional tax savings compared to prior years.

2. Relief for Workers with Supplemental Income

Although not retiree-specific, the bill allows households to deduct up to $12,500 (single) or $25,000 (joint) from tip and overtime income. For retirees working part-time, this can reduce taxable income and preserve more retirement cash flow.

3. Broader Tax Breaks and Credits

The bill expands deductions in several areas, including interest on certain loans, child tax credits, and deductions for state and local taxes. These changes can indirectly benefit households that are still supporting family members or carrying certain types of debt.

4. Expanded SALT Deduction Cap

The law temporarily increases the cap on state and local tax (SALT) deductions from $10,000 to $40,000 starting in 2025, or $20,000 for married couples filing separately. The cap will increase by 1 percent annually through 2029 before reverting to $10,000 in 2030.

High-income taxpayers will see a phaseout of this expanded benefit. The deduction is reduced by 30 percent of any income over $500,000 (single or joint) or $250,000 (married filing separately), but it will never drop below the $10,000 baseline.

New Challenges: Medicare Changes Under OBBBA

While the bill introduces generous tax deductions, it also creates significant challenges in the area of healthcare planning.

Automatic Spending Reductions

Starting in 2026, Medicare will face approximately $500 billion in funding cuts over an eight-year period. These cuts are expected to lower reimbursements to providers, which could limit access to care or shift more costs to retirees.

Drug Price Negotiation Delays

The law delays Medicare’s ability to negotiate prices on several high-cost prescription drugs. Some medications are exempt from negotiation entirely, while others will not face negotiated pricing until later in the decade. For retirees who rely on these drugs, this could mean higher out-of-pocket expenses in the years ahead.

Eligibility Restrictions for Non-Citizens

Beginning in 2027, Medicare eligibility rules will tighten for certain non-citizens, including refugees and asylum seekers. Current enrollees are temporarily protected, but new applicants in these groups may lose access.

Limits on Medicare Savings Programs

Medicare Savings Programs (MSPs) help low-income seniors pay for premiums, deductibles, and coinsurance. OBBBA blocks recent expansions that would have made these programs easier to access. This means many retirees who might have qualified for help with premiums and out-of-pocket costs will no longer get it.

Examples:

A widow living on $1,400/month Social Security could have qualified for QMB, which pays the Part B premium and reduces out-of-pocket costs. Under OBBBA, she remains ineligible and pays her $174/month Part B premium out of pocket.

A retired couple with $2,200/month income might have qualified for SLMB or QI to cover their Part B premiums. With stricter limits, they are denied because their modest retirement savings push them over the old asset cap.

A 64-year-old disabled worker could have been auto-enrolled in QDWI to cover Part A premiums. Under OBBBA, he faces stricter asset and income tests, leaving him without coverage.

The Impact on Retirement Planning

Lower Tax Burden Creates More Flexibility

The larger senior deduction can lower the tax impact on Social Security and other taxable income. This leaves retirees with more disposable income to use for daily living, leisure, or legacy goals.

Social Security Faces Added Pressure

By reducing federal revenue, the bill is expected to place additional strain on Social Security’s trust funds. While the impact is measured in months rather than years, it underscores the importance of not relying solely on government programs for retirement income.

Chart via Committee for a Responsible Federal Budget (CRFB), illustrating the CBO’s updated projection that the Social Security Trust Fund will be exhausted by 2030—one year earlier than prior forecasts.

Source: “CBO: Social Security Trust Fund To Be Exhausted 1 Year Earlier, in 2030,” CRFB blog.

Healthcare Planning Becomes More Urgent

Medicare changes highlight the importance of reviewing supplemental insurance, long-term care planning, and overall healthcare strategies. Retirees should prepare for potentially higher prescription costs and reduced program support.

Temporary vs. Permanent Changes

Some of the deductions, including the senior-specific relief, are only in place through 2028. This creates opportunities to plan short-term tax strategies now, while also ensuring that your long-term retirement plan is built on provisions that are more permanent.

What This Means for You

The new tax law offers retirees meaningful opportunities to keep more of their hard-earned money. At the same time, it raises the stakes for healthcare planning, Social Security strategy, and income protection.

Our role is to help you capture the immediate benefits while also preparing for the potential challenges ahead. By aligning your retirement income and healthcare plan with these new provisions, we can help you secure both the present and the future.

Take the Next Step

The rules have changed, but your retirement goals remain the same. If you are 65 or older, or approaching retirement, this is the time to review your tax, income, and healthcare strategy.

Schedule a complimentary retirement review with our team today and learn how the One Big Beautiful Bill may impact your future.