What's Next for the Federal Reserve: New Leadership and Interest Rates

The Federal Reserve—often called "the Fed"—is very important for investors who are saving for the long term. The Fed helps keep the economy and financial system running smoothly. In 2026, the Fed will be especially important because Jerome Powell's time as Fed Chair ends in May. This means the White House will choose a new leader for the Fed, which could change how the Fed makes decisions. These changes could affect interest rates, the stock market, and your investments.

News stories often talk about what the Fed will do with interest rates next. But there's a bigger question being discussed on Wall Street and in Washington: What should the Fed's job really be? The Fed's responsibilities have grown over the years as it has responded to financial problems and economic changes. Many investors have different opinions about how much power the Fed should have and what it should do about interest rates and the money supply.

As we look ahead to next year, these questions matter because they affect both the Fed's immediate decisions and its long-term future. What do investors need to know as Fed news fills the headlines in the coming months?

The Fed's job has grown bigger over time

The Federal Reserve was created by the Federal Reserve Act of 1913. It was the third try at creating a central bank for the United States. The Fed is not part of the federal government, and it wasn't created by the Constitution. This creates three main concerns about Fed independence: 1) its responsibilities have grown a lot over time, 2) Fed officials are not elected by voters, and 3) elected politicians often want lower interest rates to help the economy grow and create jobs.

When Congress first created the Fed, its main job was to stop bank panics. During the 1800s and early 1900s, these panics happened often and caused big problems for businesses and regular Americans. The worst crises from that time include the Great Depression, the Panic of 1907, and the Panic of 1893. Usually, these crises happened or got worse when there was a "run on a bank"—when people lost trust in a bank and rushed to take out their money all at once. This threatened both the bank and the whole financial system.

While economic and financial problems still happen today, these kinds of bank panics are less common now. The Fed makes sure banks have enough money in reserve. More importantly, the Fed serves as the "lender of last resort." This means the Fed acts as a safety net when a panic might happen. Just knowing the Fed is ready to step in helps keep the financial system stable and keeps money moving smoothly. This was tested recently during the 2020 pandemic and the 2023 regional bank crisis.

Over the years, though, the Fed's job has gotten bigger. The Federal Reserve Reform Act of 1977 was passed during a time of high inflation (when prices rise quickly) and high unemployment. This law told the Fed to work toward "maximum employment, stable prices, and moderate long-term interest rates." The Fed usually focuses on the first two goals as its "dual mandate" (two main jobs). It sees the third goal as something that happens naturally when it achieves the first two.

This growth in responsibilities is often called "mission creep" because the Fed now manages not just banks, financial transactions, and the dollar's value, but the economy as a whole. Whether this is good or bad is debatable, but it explains why so much attention is paid to each Federal Open Market Committee (FOMC) interest rate decision. People watch not just for what rates will be, but for clues about how the Fed thinks about the economy.

Fed independence has pros and cons

Fed officials are chosen by the president and approved by Congress, but voters don't elect them directly. Critics say the Fed is an unelected group with huge economic power that affects all Americans. Supporters say the Fed must sometimes make unpopular decisions, including ones that might slow the economy in the short term to protect long-term growth. Both arguments have some truth, so it can be hard to keep a balanced view.

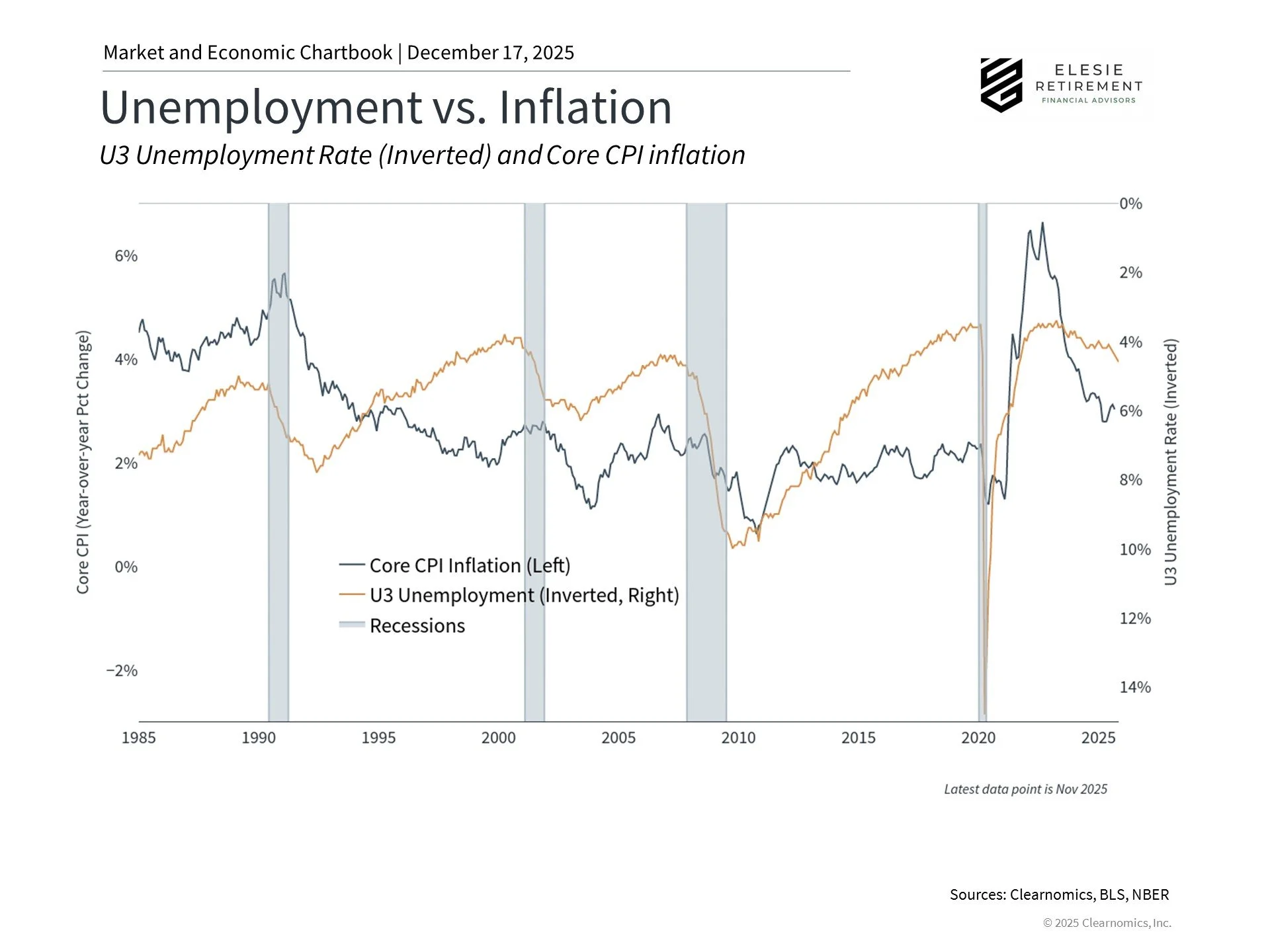

The 1970s and early 1980s are often used as a good example of this tradeoff. During the 1970s, economic shocks and political pressure for easy money policies led to "stagflation"—a combination of high inflation and high unemployment. Eventually, Fed Chair Paul Volcker raised interest rates sharply, causing a recession (an economic downturn) that eventually broke the cycle of stagflation. This helped establish Fed independence for the decades that followed.

Of course, the Fed doesn't know the future and doesn't always make the right call. Former Fed Chair Ben Bernanke famously told economist Milton Friedman "you're right, we did it"—admitting that poor Fed decisions made the Great Depression worse a century ago. More recently, many economists and investors thought the Fed was too slow to respond to inflation that started in 2021 after the pandemic. This meant the Fed had to raise interest rates quickly later on.

Even if the Fed could perfectly predict the future, its tools are limited. The Fed mainly controls short-term interest rates through something called the federal funds rate. This is often called a "blunt instrument" because adjusting just one rate can't solve many of the deeper problems in the economy. This includes supply chain problems that started in 2020 and drove inflation higher, uncertainty about tariffs, or potential job market changes due to artificial intelligence.

Also, the Fed can only indirectly influence longer-term interest rates, which matter more for home mortgages, business loans, and investment decisions. These longer-term rates are set by market forces including inflation expectations, government spending and taxes, and economic growth. So while the Fed is often seen as controlling the economy and financial system, it's really more often influencing markets or reacting to events rather than directly controlling them.

Leadership changes could shape the Fed's direction in 2026 and beyond

With Fed Chair Jerome Powell's term ending soon, the White House is expected to name a replacement early in 2026. Right now, the leading candidates include Kevin Warsh, a former Fed governor, and Kevin Hassett, Director of the National Economic Council at the White House. Much could change between now and the final decision, and the leading candidates have shifted even in just the past few months.

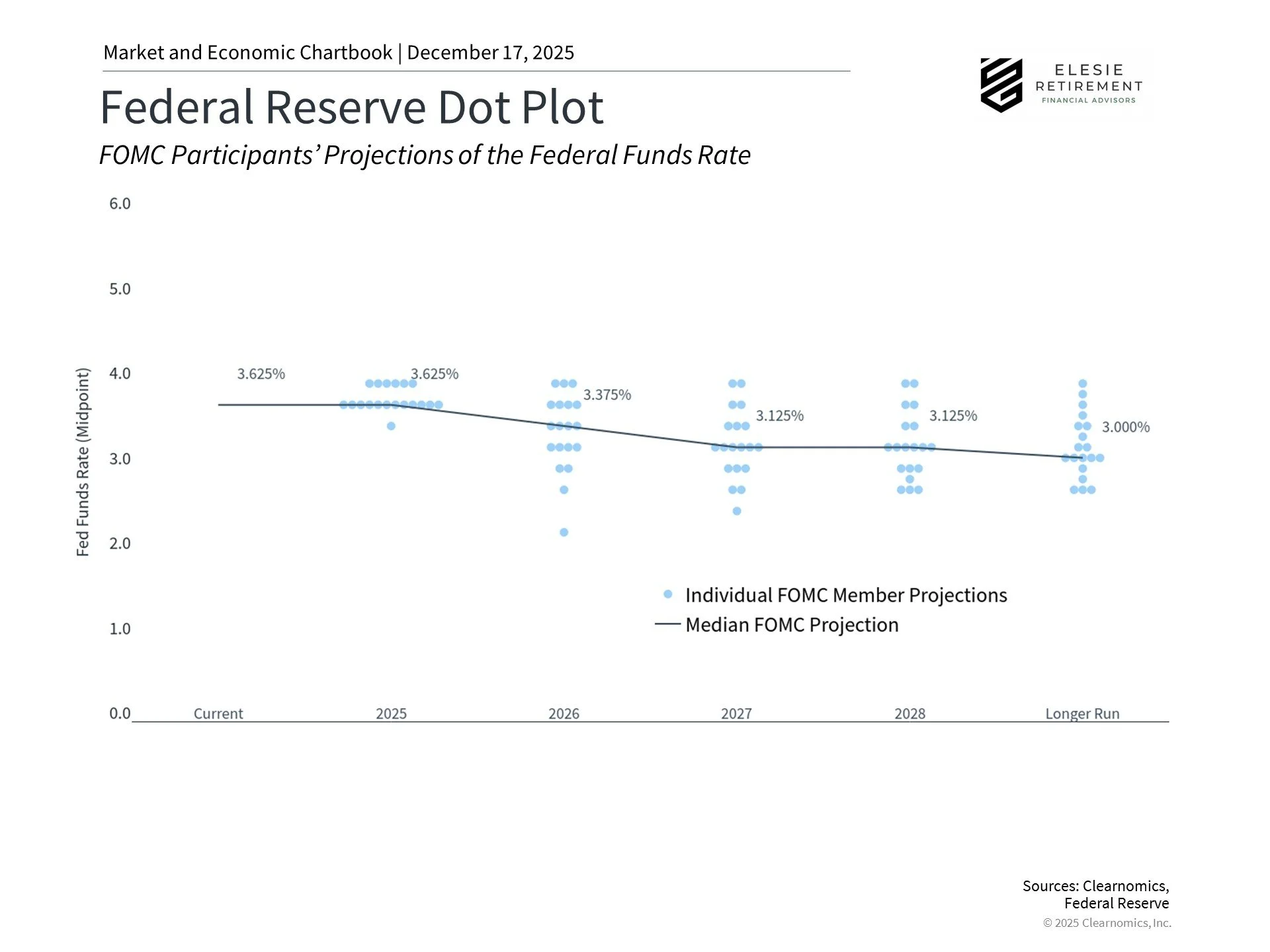

The chart above shows the FOMC's latest Summary of Economic Projections—basically, the Fed's best guesses about the future. These numbers suggest the Fed may cut rates (lower them) only once in 2026 and once in 2027. No matter who becomes the next Fed Chair, the administration will likely choose someone who prefers to keep interest rates lower. This means these projections might change in the coming months.

At the same time, it's important not to overreact to potential policy changes. While the Fed Chair has influence over policy and speaks for the FOMC at press conferences, the committee includes twelve voting members with different views. This includes the New York Fed President, seven Fed governors, and four regional bank presidents who rotate annually. Historically, the Fed has tried to reach agreement among its members. So even a Chair who agrees with the administration will need to convince other committee members using economic reasoning and policy arguments.

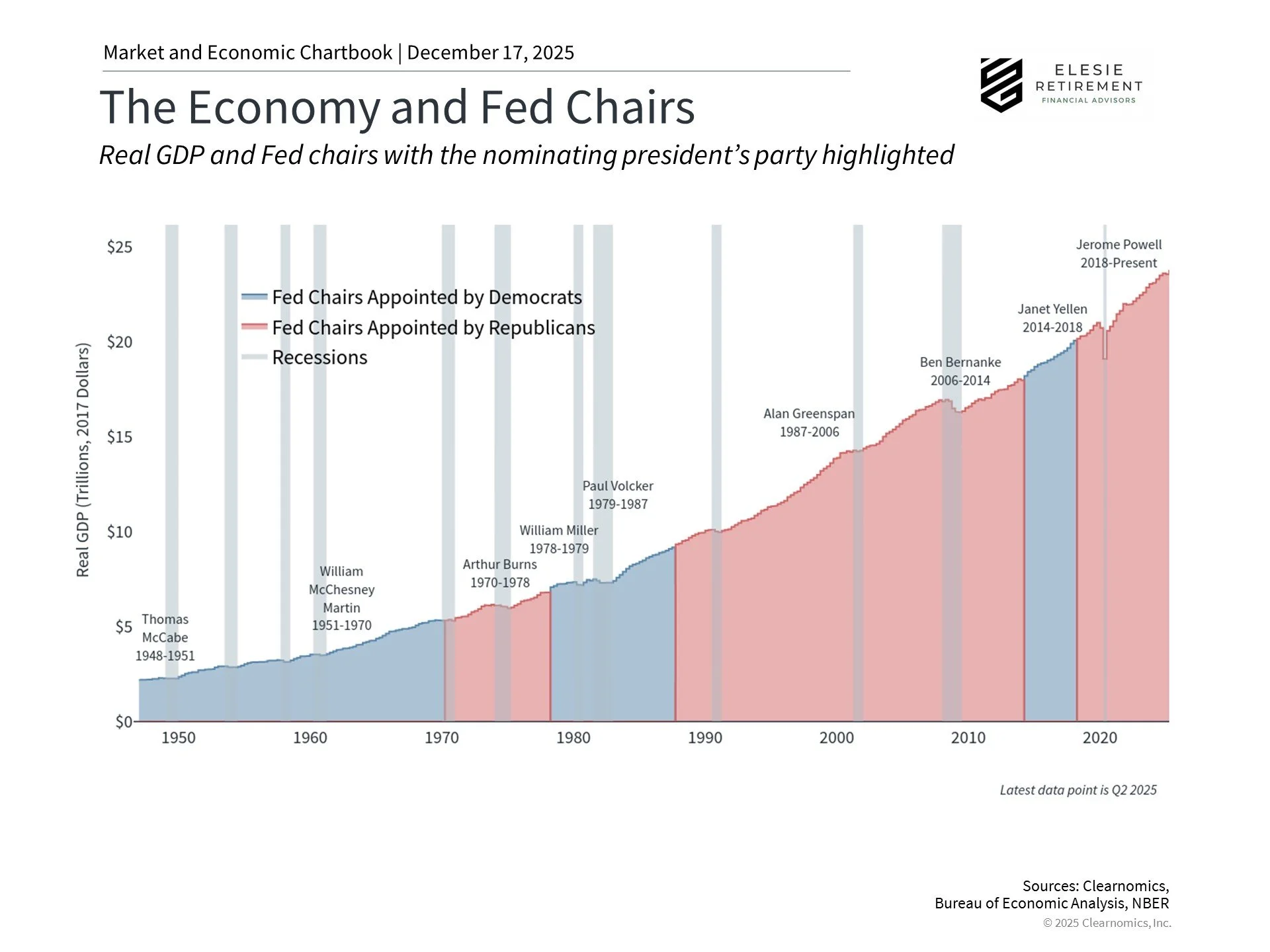

It helps to take a bigger-picture view here since this isn't the first time the Fed has changed leadership. The first chart above shows that the economy has grown steadily under different Fed Chairs appointed by both political parties. It's also worth remembering that Jerome Powell was first nominated by President Trump during his first term and stayed on as Fed Chair during President Biden's term.

What matters more than any individual Chair is whether the Fed's policies fit current economic conditions. Again, the Fed is often reacting to unexpected events beyond its control, rather than directly steering the economy.

Economic trends matter more than individual Fed decisions

While there will be many more news stories about Fed leadership in the coming months, what really matters is the overall direction of the economy. The next Fed Chair may generally prefer lower interest rates, but this will depend heavily on whether the job market stays weak and whether inflation continues to stabilize. For investors, the key is to keep a portfolio that matches your financial goals rather than react to daily speculation about the Fed.

The bottom line? History shows that markets have done well under different Fed Chairs and different policy approaches. For investors, focusing on long-term trends is still the best way to reach your financial goals.